maine excise tax credit

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that.

Maine Form 1040me 2015 Fill Out Sign Online Dochub

Visit the Maine Revenue Service page for updated mil rates.

. Any owner who has paid the excise tax for a watercraft which is transferred in the same tax year is entitled to a credit to the maximum amount of the tax previously paid in that year for any. To complete the registration process car owners need to pay an excise tax on their vehicle. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Motor Vehicle Excise Tax Finance Department. These costs dont end there however.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. In Maine the excise tax is based on the. The excise tax you pay goes to the construction and repair of.

YEAR 1 0240 mil rate YEAR 2. Mil rate is the rate used to calculate excise tax. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident. When an individual visits their Town or City Hall to make their registration payment theyre also charged an agent fee with costs varying. An excise tax is imposed on the privilege of manufacturing and selling low-alcohol spirits products and fortified wines in the State.

Renewable Energy Investment Exemption Application PDF Veteran Exemption - A veteran who. Excise tax is defined by Maine law as a tax levied annually for the privilege of. Income Tax Credits Individual income tax credits provide a partial.

As of August 2014 mil rates are as follows. Except as provided in subsection 2-A the in-state manufacturer or importing wholesale licensee shall pay an excise tax of 60 per gallon on all wine other than sparkling wine fortified wine or. 3 hours ago The excise tax due will be 61080.

Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief. The yearly cost of registration is 35. Except as provided in subsection 2A the in-state.

Taxpayers must apply for the credit by April 1 of the first year the exemption is requested. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise. 1 Research Expense Tax Credit statute 36 5219-K A taxpayer is allowed a credit against the tax due under this Part equal to the sum of 5 of the excess if any of the qualified research.

18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that. How much is the credit Well the excise tax you already paid was 44100 and the excise tax on the car youre registering today is 26350 So Ive got a credit of over 17500.

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

Maine Car Registration A Helpful Illustrative Guide

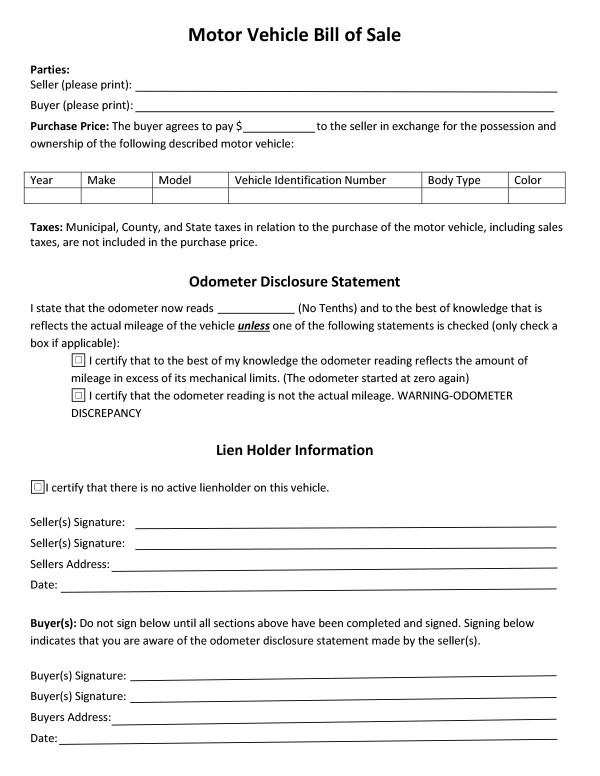

All About Bills Of Sale In Maine The Forms And Facts You Need

What You Need To Know About The Inflation Reduction Act Of 2022 Bernstein Shur Law Firm

Fillable Online Maine Industrial Users Blanket Certificate Of Exemption Form Fax Email Print Pdffiller

Maine State Revenues Beer Tax Stamp B1 Og Mnh Me Ebay

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Want To Lower Maine S Tax Burden Don T Forget To Consider Raising Incomes

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Home Page Strong Maine The Official Municipal Website For Strong

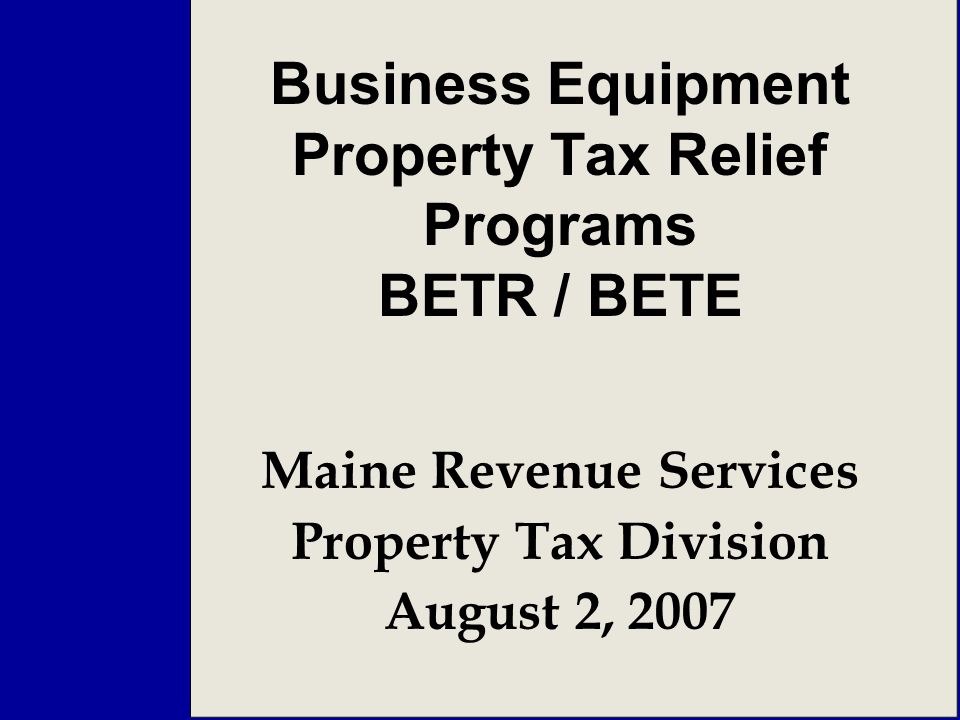

Business Equipment Property Tax Relief Programs Betr Bete Maine Revenue Services Property Tax Division August 2 Ppt Download

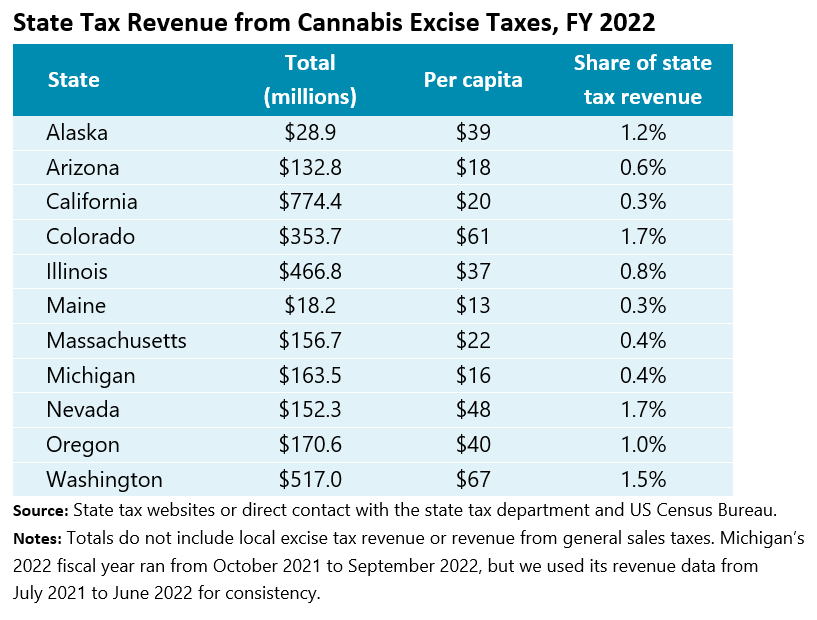

Cannabis Taxes Urban Institute

Two State Of Maine Beer Excise Tax Stamps One Pint S133 Ebay

Maine Car Registration A Helpful Illustrative Guide

Sales Fuel And Special Tax Division Maine Gov

Maine Income Tax Calculator Smartasset

It Is A Pickup Truck At Least In Maine It Is Hyundai Santa Cruz Forum